What’s Inside the Article - 📊 Credit Score Basics: What impacts your score? - 🛠️ 5 Actionable Strategies: Debt management, credit utilization, and more. - 🚫 Common Myths Debunked: What doesn’t work. - 🔍 Tools & Resources: Free credit monitoring apps. - 🏆 Long-Term Maintenance: Keep your score soaring.

Introduction: Why Improving Your Credit Score Changes Everything

A strong credit score opens doors to lower mortgage rates, better loan terms, and financial flexibility. Whether you’re recovering from past mistakes or building credit for the first time, this guide reveals five proven ways to improve your credit score—without gimmicks.

First, let’s demystify how credit scores work.

Understanding Credit Scores: The Foundation to Improve Your Credit Score

Your credit score (300–850) reflects creditworthiness. Key factors:

– Payment History (35%): Late payments hurt most.

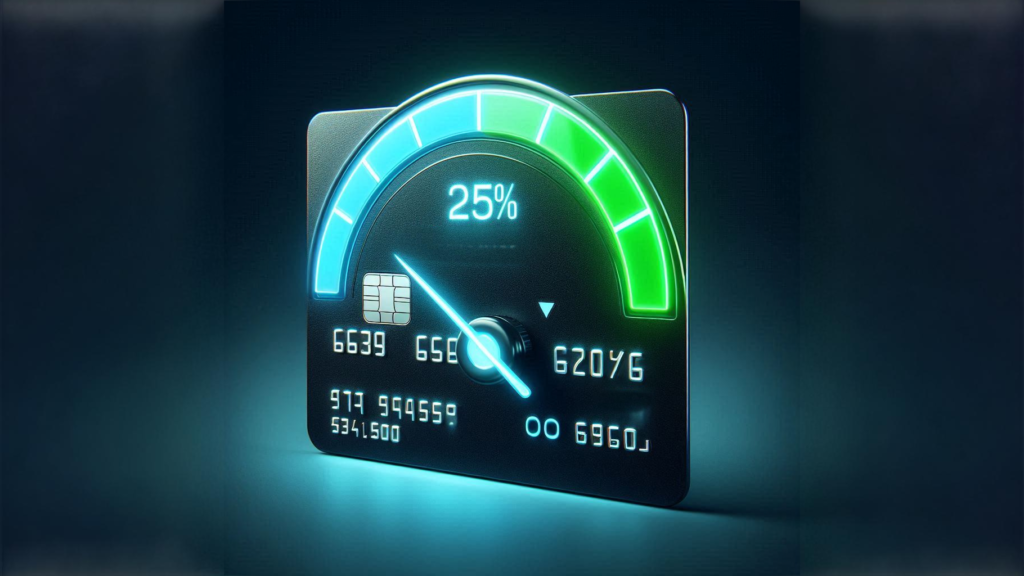

– Credit Utilization (30%): Keep balances below 30% of limits.

– Credit Age (15%): Older accounts boost scores.

Experian: How Credit Scores Work

Now, let’s dive into the five strategies.

Strategy 1: Pay Down High-Interest Debt to Improve Your Credit Score

High balances spike utilization ratios. Tactics:

– Debt Snowball: Pay smallest debts first for quick wins.

– Balance Transfers: Move debt to 0% APR cards.

Next, tackle credit utilization.

Strategy 2: Optimize Credit Utilization to Improve Your Credit Score

Aim for <30% utilization per card. Tips:

– Request Limit Increases: Lowers utilization without paying debt.

– Spread Purchases: Use multiple cards lightly.

Errors can drag your score down—let’s fix them.

Strategy 3: Dispute Errors to Improve Your Credit Score

1 in 5 reports have errors. Steps:

– Get Free Reports: AnnualCreditReport.com.

– File Disputes: Use templates from CFPB.

Rebuilding credit? Secured cards can help.

Strategy 4: Use Secured Cards to Improve Your Credit Score

Secured cards require deposits but report to bureaus. Tips:

– Choose Low-Fee Cards: Discover Secured, Capital One Platinum.

– Graduate to Unsecured: After 12 months of on-time payments.

Finally, automate to avoid mistakes.

Strategy 5: Automate Payments to Improve Your Credit Score

Late payments crush scores. Tools:

– Calendar Alerts: Set reminders 3 days before due dates.

– Apps: Mint, Credit Karma.

Conclusion: Your Path to a Brighter Financial Future

Improving your credit score isn’t a sprint—it’s a marathon. By paying strategically, optimizing utilization, and automating habits, you’ll unlock lower rates, better opportunities, and lasting financial confidence. Start today; your future self will thank you!

MORE FROM HERELMON.COM

The Money Blueprint: Mastering Financial Success in a Changing World

Crafting a Wealthy and Purposeful Life: Strategies for Financial Success

Maximizing Space: Smart Tips to Make Your Small Apartment Feel Big

How beginners can invest in 2025

Mastering the Money Mindset: Your Path to Financial Freedom

Mastering Personal Finance: Your Guide to a Secure Financial Future

Master Your 30-Day Wealth Acceleration Plan – Transform Habits to Build Riches